Blackrock will never hold 98% of the supply, they are late to the game. Plenty of wealthy people and groups will never have to sell. I shouldn't have to explain that to youWhen the markets crash and BlackRock inevitably hold 98% of global supply, it's not decentralised as intended. I shouldn't have to explain the WHY of this to you.

Hello Friend,

If this is your first visit to SoSuave, I would advise you to START HERE.

It will be the most efficient use of your time.

And you will learn everything you need to know to become a huge success with women.

Thank you for visiting and have a great day!

Where are the bitcoin lovers now?

- Thread starter marmel75

- Start date

Murk

Master Don Juan

ETFs gained 6% of total supply in a few months, and the fact that to actualise your gains you need to sell (which most will do, most smart money in 2013 cashed out by now), they will own 98%. This is because they currently own 98% of the world anyway and have too much of an advantage, it's all a facade. Let's not get petty and agree to disagree.Blackrock will never hold 98% of the supply, they are late to the game. Plenty of wealthy people and groups will never have to sell. I shouldn't have to explain that to you

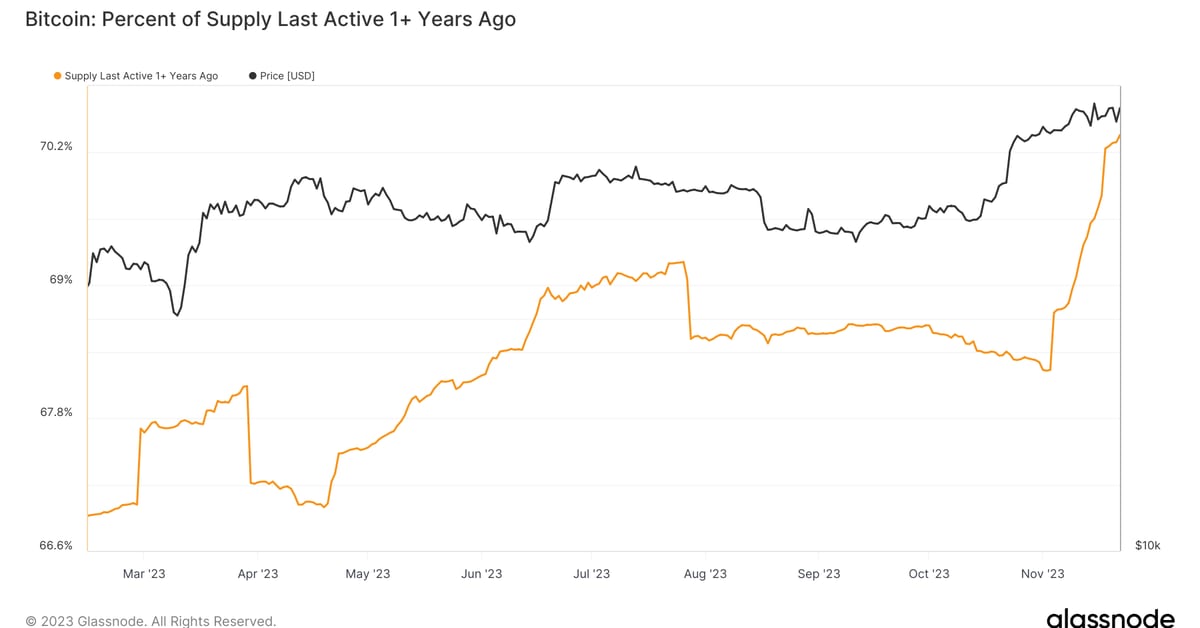

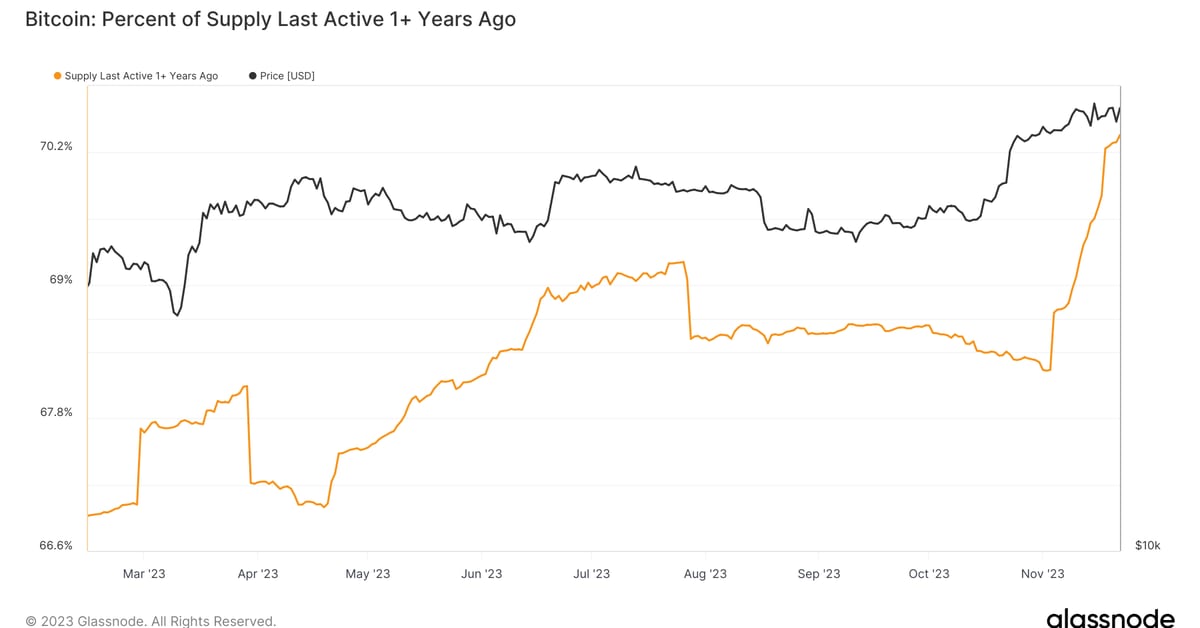

My friend, majority of the network is not for sale. 76%, i believe higher now, is in the hands of long term holders. Only around ten percent is even available on exchanges. The more ETFs and the blackrocks of the world buy, the higher the wealth and influence of long term holders are. You are missing some key points in thisETFs gained 6% of total supply in a few months, and the fact that to actualise your gains you need to sell (which most will do, most smart money in 2013 cashed out by now), they will own 98%. The is because they currently own 98% of the world anyway, it's all a facade. Let's not get petty and gree to disagree.

Hodling hard: Bitcoin’s long-term investors own over 76% of all BTC for the first time

More than 75% of the BTC supply is in the hands of Bitcoin long-term holders — a new all-time high.

sangheilios

Master Don Juan

- Joined

- Sep 25, 2018

- Messages

- 2,589

- Reaction score

- 2,632

- Age

- 34

@Murk @jaygreenb

You might want to check this out, Top 100 Richest Bitcoin Addresses and Bitcoin distribution (bitinfocharts.com)

Over 95% of all BTC is held by wallets that own .1 BTC or greater. I personally consider any wallet between .1-10 BTC as a retail account, which holds approximately 16% of the supply.

There are still roughly 2 million more BTC that have yet to be mined.

Exchanges hold approximately 2-3 million BTC from the numbers I've seen.

As for the big money players, there are tons of them.

Satoshi Nakamoto's BTC account has something like 1 million BTC or so that has not moved in years.

I've also seen some estimates that there is somewhere between 3-5 million BTC that have already been lost. There was a story from I think the UK where some guy had hundreds of millions of $ of BTC on some hard drive on his computer that was thrown away and buried at some local land fill. He even offered to split the cost to be allowed to search for it lol. This is obviously a more extreme example, but it's happened quite a lot and will continue to happen. With that said, I do believe that most of the lost BTC was from it's early days when people just had it sitting on a computer instead of on a cold wallet or something like that. However, over time there will be BTC that continues to be lost forever. It could be someone sends it to an address an incorrectly puts it in, thus it disappears forever. It also could just be put on a ledger that gets lost and the person didn't write down the code or something where a person dies and no one knows about it lol.

There are also many governments that hold a lot of BTC. The U.S has over 100k BTC, many of which were from confiscations. There are many other countries that hold sizeable hordes of BTC; Bulgaria for instance holds something around 25k BTC. El Salvador actually owns quite a bit, as not that long ago they made BTC legal tender.

Then we get into big institutions. Michael Saylor/Greyscale holds sizeable portions of BTC.

This ETF stuff we are seeing in companies like Blackrock, Fidelity and others is a huge deal, as I've stated before on here. I personally see a scenario playing out where these companies are looking to buy up these assets so that they can offer it is an investment avenue for their customers. It's as simple as a customer has a 401k or some sort of portfolio and they have the option to start allocating a percentage of it into BTC. Like with any portfolio run by these companies, it tends to be diversified based upon your age, goals, etc. A person that is younger should be more heavily invested in things that can make larger returns in a longer time frame. Meanwhile, someone who is in their 70s should be leaning more towards things that are less volatile. You literally are going to have trillions of dollars that can potentially allocated 1-3% of their liquidity into BTC.

The reality is that very few people are going to go out of their way to invest into BTC AND have to self custody this asset by buying a wallet. The crypto space is not for noobs and most people have no clue what they are doing, so naturally they are scared of this asset class. However, you take some of these big companies that now offer this as a part of your portfolio that is NOT going to disappear or become lost and people will be much more comfortable with investing into it.

@jaygreenb Brings up a solid point, which is the majority of BTC is owned by longer term holders. I'm sure some of these people will sell if we get into a crazy bull market, but I also am of the belief that many of them will just continue to hold, especially now that this asset is becoming more mainstream. Hell, BTC is starting to even become discussed on the political stage of this election cycle here in the U.S, which is a huge deal in my opinion. Vivek Ramaswamy has attended crypto/BTC conferences and openly expressed that he believes that the U.S $ should be backed by BTC, as well as other commodities. It doesn't matter if you are a supporter of him or not, this is being openly discussed on the presidential candidate stage of the most influential country in the world.

I've said this before and I'll say it again, any individual that owns 1 BTC or more is going to be doing incredibly well down the road. The number of people who will have this status I personally believe is going to cap out very soon, as it's going to become out of reach for the overwhelming majority of individuals that are not already invested in this space.

You might want to check this out, Top 100 Richest Bitcoin Addresses and Bitcoin distribution (bitinfocharts.com)

Over 95% of all BTC is held by wallets that own .1 BTC or greater. I personally consider any wallet between .1-10 BTC as a retail account, which holds approximately 16% of the supply.

There are still roughly 2 million more BTC that have yet to be mined.

Exchanges hold approximately 2-3 million BTC from the numbers I've seen.

As for the big money players, there are tons of them.

Satoshi Nakamoto's BTC account has something like 1 million BTC or so that has not moved in years.

I've also seen some estimates that there is somewhere between 3-5 million BTC that have already been lost. There was a story from I think the UK where some guy had hundreds of millions of $ of BTC on some hard drive on his computer that was thrown away and buried at some local land fill. He even offered to split the cost to be allowed to search for it lol. This is obviously a more extreme example, but it's happened quite a lot and will continue to happen. With that said, I do believe that most of the lost BTC was from it's early days when people just had it sitting on a computer instead of on a cold wallet or something like that. However, over time there will be BTC that continues to be lost forever. It could be someone sends it to an address an incorrectly puts it in, thus it disappears forever. It also could just be put on a ledger that gets lost and the person didn't write down the code or something where a person dies and no one knows about it lol.

There are also many governments that hold a lot of BTC. The U.S has over 100k BTC, many of which were from confiscations. There are many other countries that hold sizeable hordes of BTC; Bulgaria for instance holds something around 25k BTC. El Salvador actually owns quite a bit, as not that long ago they made BTC legal tender.

Then we get into big institutions. Michael Saylor/Greyscale holds sizeable portions of BTC.

This ETF stuff we are seeing in companies like Blackrock, Fidelity and others is a huge deal, as I've stated before on here. I personally see a scenario playing out where these companies are looking to buy up these assets so that they can offer it is an investment avenue for their customers. It's as simple as a customer has a 401k or some sort of portfolio and they have the option to start allocating a percentage of it into BTC. Like with any portfolio run by these companies, it tends to be diversified based upon your age, goals, etc. A person that is younger should be more heavily invested in things that can make larger returns in a longer time frame. Meanwhile, someone who is in their 70s should be leaning more towards things that are less volatile. You literally are going to have trillions of dollars that can potentially allocated 1-3% of their liquidity into BTC.

The reality is that very few people are going to go out of their way to invest into BTC AND have to self custody this asset by buying a wallet. The crypto space is not for noobs and most people have no clue what they are doing, so naturally they are scared of this asset class. However, you take some of these big companies that now offer this as a part of your portfolio that is NOT going to disappear or become lost and people will be much more comfortable with investing into it.

@jaygreenb Brings up a solid point, which is the majority of BTC is owned by longer term holders. I'm sure some of these people will sell if we get into a crazy bull market, but I also am of the belief that many of them will just continue to hold, especially now that this asset is becoming more mainstream. Hell, BTC is starting to even become discussed on the political stage of this election cycle here in the U.S, which is a huge deal in my opinion. Vivek Ramaswamy has attended crypto/BTC conferences and openly expressed that he believes that the U.S $ should be backed by BTC, as well as other commodities. It doesn't matter if you are a supporter of him or not, this is being openly discussed on the presidential candidate stage of the most influential country in the world.

I've said this before and I'll say it again, any individual that owns 1 BTC or more is going to be doing incredibly well down the road. The number of people who will have this status I personally believe is going to cap out very soon, as it's going to become out of reach for the overwhelming majority of individuals that are not already invested in this space.

Well written post. I think the disconnect is when someone has not done the work to really understand what Bitcoin is outside of the price action, which initially draws us all in. For many, it is not just a trade but an exit from the system, a protest against corrupt politicans/central banks, freedom from censorship and being frozen out of the financial system, a life raft from runaway inflation, an ability to leave a jurisdiction not treating you fairly etc A majority if not all of my bitcoin will never be for sale and as it becomes more integrated into the everyday life a legitimate option would just be to borrow against it since it is such a superior piece of collateral. Every cycle there is a growing base of people/groups/countries who share similar beliefs. This is why I believe someone like a Blackrock will never be able to completely take ownership pf the network. I do agree though that they will continue to accumulate more and some percentage will sell as price goes up.@Murk @jaygreenb

You might want to check this out, Top 100 Richest Bitcoin Addresses and Bitcoin distribution (bitinfocharts.com)

Over 95% of all BTC is held by wallets that own .1 BTC or greater. I personally consider any wallet between .1-10 BTC as a retail account, which holds approximately 16% of the supply.

There are still roughly 2 million more BTC that have yet to be mined.

Exchanges hold approximately 2-3 million BTC from the numbers I've seen.

As for the big money players, there are tons of them.

Satoshi Nakamoto's BTC account has something like 1 million BTC or so that has not moved in years.

I've also seen some estimates that there is somewhere between 3-5 million BTC that have already been lost. There was a story from I think the UK where some guy had hundreds of millions of $ of BTC on some hard drive on his computer that was thrown away and buried at some local land fill. He even offered to split the cost to be allowed to search for it lol. This is obviously a more extreme example, but it's happened quite a lot and will continue to happen. With that said, I do believe that most of the lost BTC was from it's early days when people just had it sitting on a computer instead of on a cold wallet or something like that. However, over time there will be BTC that continues to be lost forever. It could be someone sends it to an address an incorrectly puts it in, thus it disappears forever. It also could just be put on a ledger that gets lost and the person didn't write down the code or something where a person dies and no one knows about it lol.

There are also many governments that hold a lot of BTC. The U.S has over 100k BTC, many of which were from confiscations. There are many other countries that hold sizeable hordes of BTC; Bulgaria for instance holds something around 25k BTC. El Salvador actually owns quite a bit, as not that long ago they made BTC legal tender.

Then we get into big institutions. Michael Saylor/Greyscale holds sizeable portions of BTC.

This ETF stuff we are seeing in companies like Blackrock, Fidelity and others is a huge deal, as I've stated before on here. I personally see a scenario playing out where these companies are looking to buy up these assets so that they can offer it is an investment avenue for their customers. It's as simple as a customer has a 401k or some sort of portfolio and they have the option to start allocating a percentage of it into BTC. Like with any portfolio run by these companies, it tends to be diversified based upon your age, goals, etc. A person that is younger should be more heavily invested in things that can make larger returns in a longer time frame. Meanwhile, someone who is in their 70s should be leaning more towards things that are less volatile. You literally are going to have trillions of dollars that can potentially allocated 1-3% of their liquidity into BTC.

The reality is that very few people are going to go out of their way to invest into BTC AND have to self custody this asset by buying a wallet. The crypto space is not for noobs and most people have no clue what they are doing, so naturally they are scared of this asset class. However, you take some of these big companies that now offer this as a part of your portfolio that is NOT going to disappear or become lost and people will be much more comfortable with investing into it.

@jaygreenb Brings up a solid point, which is the majority of BTC is owned by longer term holders. I'm sure some of these people will sell if we get into a crazy bull market, but I also am of the belief that many of them will just continue to hold, especially now that this asset is becoming more mainstream. Hell, BTC is starting to even become discussed on the political stage of this election cycle here in the U.S, which is a huge deal in my opinion. Vivek Ramaswamy has attended crypto/BTC conferences and openly expressed that he believes that the U.S $ should be backed by BTC, as well as other commodities. It doesn't matter if you are a supporter of him or not, this is being openly discussed on the presidential candidate stage of the most influential country in the world.

I've said this before and I'll say it again, any individual that owns 1 BTC or more is going to be doing incredibly well down the road. The number of people who will have this status I personally believe is going to cap out very soon, as it's going to become out of reach for the overwhelming majority of individuals that are not already invested in this space.

sangheilios

Master Don Juan

- Joined

- Sep 25, 2018

- Messages

- 2,589

- Reaction score

- 2,632

- Age

- 34

While they were **** companies, BlockFi and Celsius were starting to touch upon this idea of borrowing against your crypto way back in 2020 and into 2021, though they both fell apart in 2022 along with other lending platforms. I actually believe this may be a real thing in the not too distant future with tradfi. I'm not entirely sure how it would play out though, but it may be a scenario where banks can hold your BTC like they do with FIAT for instance. I do know that the state of Louisiana passed a law that allowed banks to be custodians for their customers' crypto, pretty sure that took place in 2021.Well written post. I think the disconnect is when someone has not done the work to really understand what Bitcoin is outside of the price action, which initially draws us all in. For many, it is not just a trade but an exit from the system, a protest against corrupt politicans/central banks, freedom from censorship and being frozen out of the financial system, a life raft from runaway inflation, an ability to leave a jurisdiction not treating you fairly etc A majority if not all of my bitcoin will never be for sale and as it becomes more integrated into the everyday life a legitimate option would just be to borrow against it since it is such a superior piece of collateral. Every cycle there is a growing base of people/groups/countries who share similar beliefs. This is why I believe someone like a Blackrock will never be able to completely take ownership pf the network. I do agree though that they will continue to accumulate more and some percentage will sell as price goes up.

My personal opinion is that tradfi and people like Blackrock just want to get in on the action, as they recognize that there is growing retail interest in BTC/crypto.

Blockfi and Celsius basically operated as a psuedo hedge fund and ponzi scheme, completely unsustainable and depended on marketing funds to pay interest, constant new deposits and doing incredibly risky and inappropriate moves like trying to play the gbtc premium. Just a complete shtshow of incompetence and corrupt behavior. I think there will likely be sustainable and risk appropriate options in the future. Some may not include them taking full custody of your bitcoin but will have to see how everything unfolds. Imagine will be highly dependent on the indicidual or corp. Agree, tradfi just really wants the fees and a piece of the action and doubt they will contribute all that much outside of what they can make money off of.While they were **** companies, BlockFi and Celsius were starting to touch upon this idea of borrowing against your crypto way back in 2020 and into 2021, though they both fell apart in 2022 along with other lending platforms. I actually believe this may be a real thing in the not too distant future with tradfi. I'm not entirely sure how it would play out though, but it may be a scenario where banks can hold your BTC like they do with FIAT for instance. I do know that the state of Louisiana passed a law that allowed banks to be custodians for their customers' crypto, pretty sure that took place in 2021.

My personal opinion is that tradfi and people like Blackrock just want to get in on the action, as they recognize that there is growing retail interest in BTC/crypto.

Murk

Master Don Juan

Ok, you don't understand the simple English I typed so I will make it extremely simple for you.Well written post. I think the disconnect is when someone has not done the work to really understand what Bitcoin is outside of the price action, which initially draws us all in. For many, it is not just a trade but an exit from the system, a protest against corrupt politicans/central banks, freedom from censorship and being frozen out of the financial system, a life raft from runaway inflation, an ability to leave a jurisdiction not treating you fairly etc A majority if not all of my bitcoin will never be for sale and as it becomes more integrated into the everyday life a legitimate option would just be to borrow against it since it is such a superior piece of collateral. Every cycle there is a growing base of people/groups/countries who share similar beliefs. This is why I believe someone like a Blackrock will never be able to completely take ownership pf the network. I do agree though that they will continue to accumulate more and some percentage will sell as price goes up.

How is it an exit from the system when the system eventually own it?

BlackRock (IMO!) is here for a heist, they will grab up as much BTC as possible and BTC will not be accessible to the average man. It will get to a price point that is so overwhelming for the average man holding BTC - life-changing money - he will sell the BTC (to BlackRock).

Remember, BTC hasn't gone anywhere to a point where anyone has been psychologically challenged by it, in the sense of movement up, we hit the ATH and then aggressively moved away from it. The logic would say if we do surpass the ATH and continues to go beyond the $100k mark, people are going to have a relatively decent amount of BTC where they say to themselves "I'm gonna get rid of it". BTC price will skyrocket WAY BEFORE it becomes part of daily use. If you don't understand that, again, you're an idiot.

I know exactly what BTC is, you think it is an escape from the matrix, "a LiFe rAfT". I'm telling you it doesn't matter now the company that owns the world will own the majority of BTC too.

Don't take subversive, female cheap shots at me while quoting another comment, you're a fvcking basic b*tch.

Fortune_favors_the_bold

Master Don Juan

If blackrock will pay 1 million per BTC I would say 90% of people would sell it...then if that scenario happens it could become a world reserve currency and the fair value compared to goods will be much higher.

So you will have bitcoiners (wealthy classes) travelling, owning houses and eating meat while the pleb enjoy their restricted diet in their 15 minutes cities.

I would have laught at myself if reading such comments 5 years ago but not anymore.

People dont understand the weight of blackrock and fidelity in out financial and political system.

So you will have bitcoiners (wealthy classes) travelling, owning houses and eating meat while the pleb enjoy their restricted diet in their 15 minutes cities.

I would have laught at myself if reading such comments 5 years ago but not anymore.

People dont understand the weight of blackrock and fidelity in out financial and political system.

You don't need to make it simple for me, you obviously do not understand how the network works. Owning a lot of bitcoin does not allow them to control of censor the network. Mining and node distribution makes that impossible. It has zero effect on how the decentralized properties are applied on an individual level.Ok, you don't understand the simple English I typed so I will make it extremely simple for you.

How is it an exit from the system when the system eventually own it?

BlackRock (IMO!) is here for a heist, they will grab up as much BTC as possible and BTC will not be accessible to the average man. It will get to a price point that is so overwhelming for the average man holding BTC - life-changing money - he will sell the BTC (to BlackRock).

Remember, BTC hasn't gone anywhere to a point where anyone has been psychologically challenged by it, in the sense of movement up, we hit the ATH and then aggressively moved away from it. The logic would say if we do surpass the ATH and continues to go beyond the $100k mark, people are going to have a relatively decent amount of BTC where they say to themselves "I'm gonna get rid of it". BTC price will skyrocket WAY BEFORE it becomes part of daily use. If you don't understand that, again, you're an idiot.

I know exactly what BTC is, you think it is an escape from the matrix, "a LiFe rAfT". I'm telling you it doesn't matter now the company that owns the world will own the majority of BTC too.

Don't take subversive, female cheap shots at me while quoting another comment, you're a fvcking basic b*tch.

I have already made life changing/retirement level money in Bitcoin and have not sold a single satoshi. I personally know many people who are doing the same. There is no fiat dollar amount I am selling the majority if any of my Bitcoin. Maybe time for you to self reflect, learn some more and realize it might be you who is the "idiot". There are many of us out there not trying to day trade our way to a few grand. Your "logic" only applies to those with a similar mindset to you. I'll be direct, I think you are a broke bitter idiot. Good enough?

Will add if you think this is a cheap shot, you are incredibly insecure and mentally unstable.

Well written post. I think the disconnect is when someone has not done the work to really understand what Bitcoin is outside of the price action, which initially draws us all in.

Last edited:

90% is a guess with nothing actually backing that assumption. I am not going to pretend to know the answer either but personally think that percentage it is much much lower. Also, there are many people/corps/govts also vying for that same bitcoin, not sure why people think they would go away and blackrock would be the only buyer.If blackrock will pay 1 million per BTC I would say 90% of people would sell it...then if that scenario happens it could become a world reserve currency and the fair value compared to goods will be much higher.

So you will have bitcoiners (wealthy classes) travelling, owning houses and eating meat while the pleb enjoy their restricted diet in their 15 minutes cities.

I would have laught at myself if reading such comments 5 years ago but not anymore.

People dont understand the weight of blackrock and fidelity in out financial and political system.

sangheilios

Master Don Juan

- Joined

- Sep 25, 2018

- Messages

- 2,589

- Reaction score

- 2,632

- Age

- 34

If blackrock will pay 1 million per BTC I would say 90% of people would sell it...then if that scenario happens it could become a world reserve currency and the fair value compared to goods will be much higher.

So you will have bitcoiners (wealthy classes) travelling, owning houses and eating meat while the pleb enjoy their restricted diet in their 15 minutes cities.

I would have laught at myself if reading such comments 5 years ago but not anymore.

People dont understand the weight of blackrock and fidelity in out financial and political system.

Here's the take I have on this.90% is a guess with nothing actually backing that assumption. I am not going to pretend to know the answer either but personally think that percentage it is much much lower. Also, there are many people/corps/govts also vying for that same bitcoin, not sure why people think they would go away and blackrock would be the only buyer.

The number of people that are even into BTC/crypto on any serious level are a very small percentage of the population. Using that BTC rich list site I had cited on here, there are a little over 3 million addresses that own $10,000 of BTC or more. This may sound like a lot of people, but this is for the entire world population. Hell, even if they all were in the U.S they would represent less than 1% of the total population. These are very rare individuals in the grand scheme of things that also probably understand the fundamentals of BTC and will probably NOT sell much, if at all. No one without a strong conviction with BTC/crypto is going to have that much money invested, it just doesn't make any sense.

Most of the retail that has entered into the crypto space since 2017 have mostly been tourists that get completely wrecked by the market and either never revisit it again OR buy up some low cap project being shilled by some crypto youtuber. These are the types of people that would be willing to sell at the right price. However, these individuals own such a small amount of BTC, both in total and relative to the broader supply, that it's not even worth considering. Even now, owning 5% of a BTC would cost around $2500, which is actually a lot of money for most people.

As I mentioned above, even owning just 10% of 1 BTC is a very rare thing, let alone owning 1 BTC or more lol. Even I at times don't understand this fact until I look at the numbers again. I would have had a totally different investment strategy when I first got into this space in 2018 if I understood this as well as I do now.

As I've mentioned on here before, I believe that these ETFs are going to just be a means for the general population with investment portfolios to allocate a small percentage of their capital into this rapidly expanding asset class. The average person is NOT going to go out of their way to set up an account on an exchange, purchase a cold storage wallet AND have to rely upon self custody.

Last edited:

Right, it is a relatively small group that continues to grow over time with education, exposure and out of necessity. There is a reason that most alts have a relatively short life span that does not have a growing base of long term addresses in self custody while hitting new fiat highs each cycle. It is a completely different mindset than trying to time a trade. In order to weather those draw downs there has to be some level of understanding that goes beyond just a trader mindset.Here's the take I have on this.

The number of people that are even into BTC/crypto on any serious level are a very small percentage of the population. Using that BTC rich list site I had cited on here, there are a little over 3 million addresses that own $10,000 of BTC or more. This may sound like a lot of people, but this is for the entire world population. Hell, even if they all were in the U.S they would represent less than 1% of the total population. These are very rare individuals in the grand scheme of things that also probably understand the fundamentals of BTC and will probably NOT sell much, if at all. No one without a strong conviction with BTC/crypto is going to have that much money invested, it just doesn't make any sense.

Most of the retail that has entered into the crypto space since 2017 have mostly been tourists that get completely wrecked by the market and either never revisit it again OR buy up some low cap project being shilled by some crypto youtuber. These are the types of people that would be willing to sell at the right price. However, these individuals own such a small amount of BTC, both in total and relative to the broader supply, that it's not even worth considering. Even now, owning 5% of a BTC would cost around $2500, which is actually a lot of money for most people.

As I mentioned above, even owning just 10% of 1 BTC is a very rare thing, let alone owning 1 BTC or more lol. Even I at times don't understand this fact until I look at the numbers again. I would have had a totally different investment strategy when I first got into this space in 2018 if I understood this as well as I do now.

As I've mentioned on here before, I believe that these ETFs are going to just be a means for the general population with investment portfolios to allocate a small percentage of their capital into this rapidly expanding asset class. The average person is NOT going to go out of their way to set up an account on an exchange, purchase a cold storage wallet AND have to rely upon self custody.

Bitcoin Supply Inactive for a Year Hits Record High of 70%

It appears bitcoin holders are not planning on offloading inventory at these price levels or any time soon, one observer said.

sangheilios

Master Don Juan

- Joined

- Sep 25, 2018

- Messages

- 2,589

- Reaction score

- 2,632

- Age

- 34

You are totally correct. However, as time goes on the amount of BTC that investors can accumulate is going to be relatively small. As I mentioned above, even just 5% of a BTC right now would cost you $2500, which is a lot of money for most people right now. Fast forward this to the halving of 2028 and I wouldn't be surprised to see BTC consistently trading at 100k or more by then AFTER cooling off. This will continue to grow over time and eventually even getting 1% of a BTC may require a good deal of money.Right, it is a relatively small group that continues to grow over time with education, exposure and out of necessity. There is a reason that most alts have a relatively short life span that does not have a growing base of long term addresses in self custody while hitting new fiat highs each cycle. It is a completely different mindset than trying to time a trade. In order to weather those draw downs there has to be some level of understanding that goes beyond just a trader mindset.

Bitcoin Supply Inactive for a Year Hits Record High of 70%

It appears bitcoin holders are not planning on offloading inventory at these price levels or any time soon, one observer said.www.coindesk.com

I personally saw BTC at 120-150k for the next all time high, but this ETF stuff completely changes this. I think that we may see this go substantially higher than these numbers potentially but also with the added caveat that there will also be substantially less volatility. It's going to be hard to predict. From the numbers I've seen, retail interest is still substantially lower than what we saw in late 2021. I'm seeing something where this continues for a good chunk of the year until we break the previous all time high of 69k. When this happens, we are going to see it being covered by all the major news channels. Not long after that I would expect massive retail FOMO and when everything in the market is pumping and meme coins are being hyped up it's a time that the top may be in.

With that said, I think it's going to be quite a while before we see this happen. I'm seeing a lot of talks of the FED not looking to cut rates until later in the year, first it was March, then May and now I'm seeing July floating around now. It's going to be hard to predict, but I think that by election time we will probably be on track for the true bull run. I see the current price action of the last few months as more of a local top based around the ETF hype. I could see it kind of stagnating around here for a while or decreasing slightly but nothing outrageous barring any black swan events.

There is still plenty of time to buy up this market before things really heat up.

Solomon

Master Don Juan

You don't need to make it simple for me, you obviously do not understand how the network works. Owning a lot of bitcoin does not allow them to control of censor the network. Mining and node distribution makes that impossible. It has zero effect on how the decentralized properties are applied on an individual level.

I have already made life changing/retirement level money in Bitcoin and have not sold a single satoshi. I personally know many people who are doing the same. There is no fiat dollar amount I am selling the majority if any of my Bitcoin. Maybe time for you to self reflect, learn some more and realize it might be you who is the "idiot". There are many of us out there not trying to day trade our way to a few grand. Your "logic" only applies to those with a similar mindset to you. I'll be direct, I think you are a broke bitter idiot. Good enough?

Will add if you think this is a cheap shot, you are incredibly insecure and mentally unstable.

Well written post. I think the disconnect is when someone has not done the work to really understand what Bitcoin is outside of the price action, which initially draws us all in.

Ok, you don't understand the simple English I typed so I will make it extremely simple for you.

How is it an exit from the system when the system eventually own it?

BlackRock (IMO!) is here for a heist, they will grab up as much BTC as possible and BTC will not be accessible to the average man. It will get to a price point that is so overwhelming for the average man holding BTC - life-changing money - he will sell the BTC (to BlackRock).

Remember, BTC hasn't gone anywhere to a point where anyone has been psychologically challenged by it, in the sense of movement up, we hit the ATH and then aggressively moved away from it. The logic would say if we do surpass the ATH and continues to go beyond the $100k mark, people are going to have a relatively decent amount of BTC where they say to themselves "I'm gonna get rid of it". BTC price will skyrocket WAY BEFORE it becomes part of daily use. If you don't understand that, again, you're an idiot.

I know exactly what BTC is, you think it is an escape from the matrix, "a LiFe rAfT". I'm telling you it doesn't matter now the company that owns the world will own the majority of BTC too.

Don't take subversive, female cheap shots at me while quoting another comment, you're a fvcking basic b*tch.

This is a great discussion guys let's not derail it with pettiness. We are having a historic conversation that if the website is up 20 years from now people will case study (deada$$ serious)If blackrock will pay 1 million per BTC I would say 90% of people would sell it...then if that scenario happens it could become a world reserve currency and the fair value compared to goods will be much higher.

So you will have bitcoiners (wealthy classes) travelling, owning houses and eating meat while the pleb enjoy their restricted diet in their 15 minutes cities.

I would have laught at myself if reading such comments 5 years ago but not anymore.

People dont understand the weight of blackrock and fidelity in out financial and political system.

A buddy of mine and I have had various conversations that most would consider conspiracy theories heh

He read the Blackrock ETF filing(I haven't had a chance yet) but in the filing he claims it states that Blackrock can change the definition of what they deem to be Bitcoin, so in other words, if they want utilize Bitcoin Cash Or Bitcoin SV they can

Shocking find in Blackrock #Bitcoin ETF filing. #BSV #shorts

#blackrock #bitcoin ETF filing shocking finds!#bsv might be their choice!

Why da eff would Blackrock use BSV? His response was that Bitcoin is to expensive to transact at these high amounts and mining on BSV is far more profitable compared to BTC as the halving will cut profitability down for miners even morso (which is true). Why would Blackrock care about mining? great question because they are the 2nd largest shareholder in 4 out of the 5 biggest minng firms!

The Craig Wright case. I won't get into detail but if Craig Wright wins they can basically buy the title from him. So in essence Blackrock can control Bitcoin.

Once again I thought he was nuts, but I started to notice between October-January BSV moved up over 110%

My buddy has a theory similar to this guy, that Blackrock will pump BTC then dump massively and move to BSV

I do think my buddy is right in regards too Blackrock will not invest in something they can't control or own the majority of. It's not their MO to be the last to the party so to speak.

Do I think Blackrock will move to BSV? I don't know but what I do know is Blackrock will manipulate the market unlike which we have ever seen before. ALl you need is a Black Swan event like March 2020 and boom you win!

I think the scary part is in 2024 you still have people who think Bitcoin is a scam. Never mind the biggest asset managers in the world are in it, Governments are in it and yes even Visa/Mastercard etc. When we move over to a full-on digital system a lot of people in the near future are going to be piss that they didn't buy BItcoin at 20K, 30K, or even 60K. Bitcoin in the next 10 years is expected to be anywhere from 250K-1 Million. Can you imagine what inflation and cost of living will be like then?

We are moving to a real Dystopian future here and a lot of people are not paying attention. I didn't even bring up Sora and Elon Musk nerualink but that's for another thread

p.s. once again this a conversation between a buddy and I click the links go down the rabbit hole. Maybe there is something to this maybe there isn't

Last edited:

sangheilios

Master Don Juan

- Joined

- Sep 25, 2018

- Messages

- 2,589

- Reaction score

- 2,632

- Age

- 34

@Solomon

I don't think it would be possible for one specific company like Blackrock to be able to control enough of the supply of BTC to totally control and manipulate it, for reasons @jaygreenb and I have mentioned. There are retail holders with strong conviction in this asset class that will very likely not sell at all, and they themselves represent a good sized portion of BTC being held. Again, I just see this as another vessel of which these institutions are looking to just enter into the space to make money, as they recognize that there is growing interest in BTC and crypto as a whole.

@Solomon and @jaygreenb

Trump: The life of our country is at stake (youtube.com)

I watched this clip from FOX last night on youtube where the question of CBDCs is brought up to Trump and then it specifically is directed towards BTC, it starts @ 3:20 if you want to skip right to it. Vivek Ramaswamy has discussed BTC several times but now this question is being openly mentioned on mainstream media towards THE presidential candidate of the U.S Republican party. This is a big deal and even just 4 years ago you would have NEVER imagined something like this ever happening.

I don't think it would be possible for one specific company like Blackrock to be able to control enough of the supply of BTC to totally control and manipulate it, for reasons @jaygreenb and I have mentioned. There are retail holders with strong conviction in this asset class that will very likely not sell at all, and they themselves represent a good sized portion of BTC being held. Again, I just see this as another vessel of which these institutions are looking to just enter into the space to make money, as they recognize that there is growing interest in BTC and crypto as a whole.

@Solomon and @jaygreenb

Trump: The life of our country is at stake (youtube.com)

I watched this clip from FOX last night on youtube where the question of CBDCs is brought up to Trump and then it specifically is directed towards BTC, it starts @ 3:20 if you want to skip right to it. Vivek Ramaswamy has discussed BTC several times but now this question is being openly mentioned on mainstream media towards THE presidential candidate of the U.S Republican party. This is a big deal and even just 4 years ago you would have NEVER imagined something like this ever happening.

Solomon

Master Don Juan

You don't need to make it simple for me, you obviously do not understand how the network works. Owning a lot of bitcoin does not allow them to control of censor the network. Mining and node distribution makes that impossible. It has zero effect on how the decentralized properties are applied on an individual level.

I have already made life changing/retirement level money in Bitcoin and have not sold a single satoshi. I personally know many people who are doing the same. There is no fiat dollar amount I am selling the majority if any of my Bitcoin. Maybe time for you to self reflect, learn some more and realize it might be you who is the "idiot". There are many of us out there not trying to day trade our way to a few grand. Your "logic" only applies to those with a similar mindset to you. I'll be direct, I think you are a broke bitter idiot. Good enough?

Will add if you think this is a cheap shot, you are incredibly insecure and mentally unstable.

Well written post. I think the disconnect is when someone has not done the work to really understand what Bitcoin is outside of the price action, which initially draws us all in.

I don't disagree with you at all brother, as mentioned prior 76% of holders are long-term holders@Solomon

I don't think it would be possible for one specific company like Blackrock to be able to control enough of the supply of BTC to totally control and manipulate it, for reasons @jaygreenb and I have mentioned. There are retail holders with strong conviction in this asset class that will very likely not sell at all, and they themselves represent a good sized portion of BTC being held. Again, I just see this as another vessel of which these institutions are looking to just enter into the space to make money, as they recognize that there is growing interest in BTC and crypto as a whole.

@Solomon and @jaygreenb

Trump: The life of our country is at stake (youtube.com)

I watched this clip from FOX last night on youtube where the question of CBDCs is brought up to Trump and then it specifically is directed towards BTC, it starts @ 3:20 if you want to skip right to it. Vivek Ramaswamy has discussed BTC several times but now this question is being openly mentioned on mainstream media towards THE presidential candidate of the U.S Republican party. This is a big deal and even just 4 years ago you would have NEVER imagined something like this ever happening.

I just found my buddies theory interesting and quite frankly I don't trust Blackrock in this space

If you are a true believer in Bitcoin and decentralization the thought of Blackrock in the space would be a major redflag

Bitcoin was supposed to be the anthesis for the Blackrocks and Institutions

However, the crypto space is not what it was in 2010, or even 2017 it's now driven by greed and more greed

I do believe that Blackrock will manipulate the market in ways that people can't imagine and when Blackrock or another institution does I won't be shocked

My own interpretation is I don't think that was the intent of the phrasing but more to give them optionality in the future if there is another fork war or for some reason the main chain needs to be abandoned. Really just to keep options open and not box themselves in, lawyer speak. Personal opinion is this has absolutely nothing to do with BSV or Bitcoin Cash. Even if Blackrock wanted to do something like, the world population can just choose not to use that chain. That is part of what makes decentralization so powerful. This is just my opinion though and I do not have any special insider info. Not directly about this topic but these videos explain on if a bad actor/corp/govt tries to take control of the network and why it would not work and would just be a waste of resources when they could just participateA buddy of mine and I have had various conversations that most would consider conspiracy theories heh

He read the Blackrock ETF filing(I haven't had a chance yet) but in the filing he claims it states that Blackrock can change the definition of what they deem to be Bitcoin, so in other words, if they want utilize Bitcoin Cash Or Bitcoin SV they can

I thought he was nuts,

Shocking find in Blackrock #Bitcoin ETF filing. #BSV #shorts

#blackrock #bitcoin ETF filing shocking finds!#bsv might be their choice!www.youtube.com

Why da eff would Blackrock use BSV? His response was that Bitcoin is to expensive to transact at these high amounts and mining BSV is far more profitable as the halving will cut profitability down for miners (which is somewhat true) craig wright case. I won't get into detail but if Craig Wright wins they can basically buy the title from him. So in essence Blackrock can control Bitcoin.

Once again I thought he was nuts, but I started to notice between October-January BSV moved up over 110%

My buddy has a theory similar to this guy, that Blackrock will pump BTC then dump massively and move to BSV

I do think my buddy is right in regards too Blackrock will not invest in something they can't control or own the majority of. It's not their MO to be the last to the party so to speak.

Do I think Blackrock will move to BSV? I don't know but what I do know is Blackrock will manipulate the market unlike which we have ever seen before. ALl you need is a Black Swan event like March 2020 and boom you win!

I think the scary part is in 2024 you still have people who think Bitcoin is a scam. Never mind the biggest asset managers in the world are in it, Governments are in it and yes even Visa/Mastercard etc. When we move over to a full-on digital system a lot of people in the near future are going to be piss that they didn't buy BItcoin at 20K, 30K, or even 60K. Bitcoin in the next 10 years is expected to be anywhere from 250K-1 Million. Can you imagine what inflation and cost of living will be like then?

We are moving to a real Dystopian future here and a lot of people are not paying attention. I didn't even bring up Sora and Elon Musk nerualink but that's for another thread

p.s. once again this a conversation between a buddy and I click the links go down the rabbit hole. Maybe there is something to this maybe there isn't

On the base layer small transactions do not need to be cheap, that can be handled on layer 2's like lightening, paypal, venmo and other payment rails. They can then do bulk settlements for non critical transactions. Important or large transactions can still be handled on the base layer, the cost really isn't prohibitive if it is an important transaction. $10-$20 really is meaningless for a million dollar plus transfer where confirmation and settlement in real time is important. It is miniscule comparatively to what it costs to do international transactions now.

I do agree though the old tradfi guard will try to keep their power and try to acquire as much influence and control that they can, just not sure that will be possible with the points already made on this thread. If this is truly a paradigm shift new groups will gain influence and old ones will lose it. This is one of the only times in history Retail has a head start on those in power