I do day trading, but it’s not my profession/career.

Forget emotions. People lose due to their emotions. They feel, they feel lucky, they feel like ****, they feel smart, they feel like they will get their money back, and after losing they can’t tell anybody due to being embarrassed.

Trading is solely of %. If you go into trading to make big gains like $20,000 a day, as you may have seen others do, well you need a million you’re willing to lose.

What I mean by % is this. If you invest $20 and get gains of 20%. That’s $4. I know you do not want to collect $4. But the reality is you have to... because if you put $200, that would be $40, and if you put $2,000 that would be $400, and if you did $20,000 it would be $4,000, and if you had the big boy money you would have put $200,000 and made $40,000.

If a person already has $200,000 for trading, that person already makes a lot of money and won’t even bother with it since they do more of long term investing. Why do I say 20%.

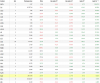

Based on any stock, check out AAL this week and last week, up and down $1-$2. But you must take that 20% gain. So let’s say you started off with $1000. You got to only 10%, take your $100, everyday. That’s $500. At the end of the month you have $2,000 and that initial $1,000, so you’re at $3,000... and I’m talking about pathetic 10% gain that you bought any stock at its best support line.

After a month, of you were taking 10% a day on $3,000, that’s $300/day, $1500/week... in 2 months you should be at $9,000.... if you stick to these principles of finding stocks at their best support lines, and taking out your 10-20% daily, soon enough 20k, needs to go up on 5% to make a $1,000 today.

So learn how to find strong support lines, and resistance lines. Observe stocks typically behavior from previous charts, but most importantly take your gains even at small amounts... they add up. If something happens and they start going down take you 20% loss as well. By knowing the support lines this is how you minimize losses.

If you’re talking about options, I would not suggest learning them. They were made for hedging, and only few people either get lucky, or they truly know what to do, which is chart patterns and buying in the money, just to resale right away for a quick 40-100% gain.

So to start, learn what support lines are. Find a great scanner where stocks dropped hugely or gained, because they will make another move just not as drastic as first. Collect your gains daily, control your emotions of being rich over night. I experienced it.. if I would’ve held for another day I would’ve made like $50,000 instead of $3,000... it used to haunt me.. it’s easy to say “I’m not greedy I’m ok it’s just money” then actually do it.