Fruitbat

Master Don Juan

- Joined

- May 3, 2013

- Messages

- 3,307

- Reaction score

- 2,409

yep. And married.Do you have kids with her?

Hello Friend,

If this is your first visit to SoSuave, I would advise you to START HERE.

It will be the most efficient use of your time.

And you will learn everything you need to know to become a huge success with women.

Thank you for visiting and have a great day!

yep. And married.Do you have kids with her?

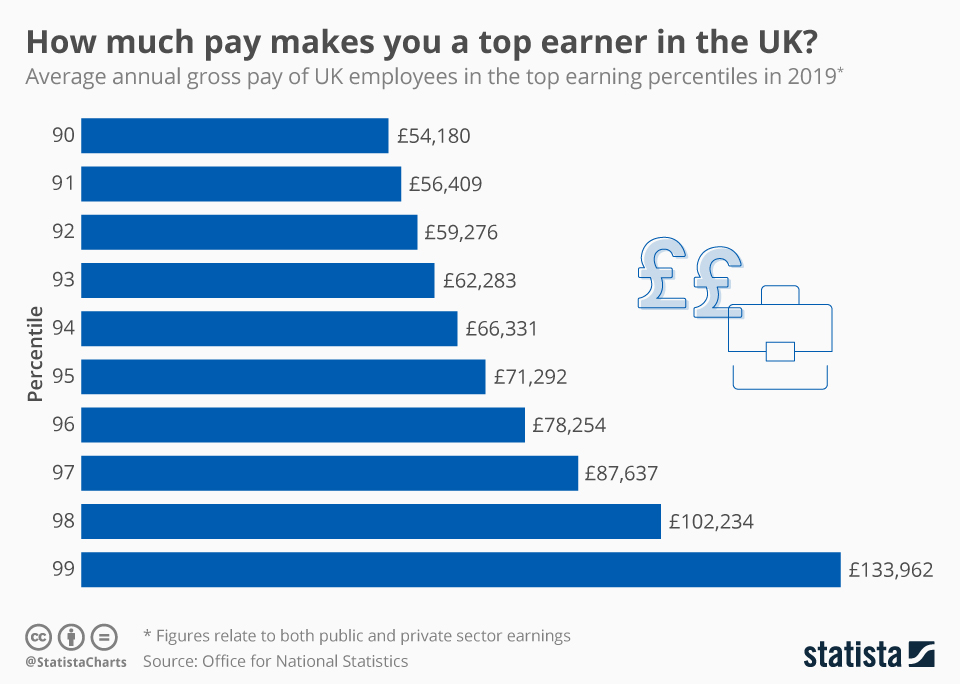

We’ll, she did have a valid point for calling you out on a top 10%I made £140,000 total package last year which is $179,000.

after taxes though it’s more like £94,000 or $120,000.

I’ve had to pay some serious bills for my house as it’s a state (renovating). I have about $10,000 in actual liquid savings I can call on. Much is tied up in pension provision.

I try to explain to my wife that I’m top 10% earners but she still says “you don’t earn that much and you’re not wealthy”.

She says she’ll only give up work to be a housewife if I can hand her $2,700 a month as an allowance.

There are lots of women I feel who would be very proud of a man making that money.

Women are born complainers. Most I’ve been with have been similar. Whatever You’ve done they are looking and desperately trying to find someone with more so they can feel miserable. They have to feel miserable at all costs!

It grinds me down a bit because realistically I dont think its possible in my career to earn much more - perhaps another 40k if im really lucky. I'm experienced and good at my job. I am kind of at the limit of what's possible.

Nothing makes me more pissed off than when she scoffs at my earnings and says "i dont see you earn much and you're still poor. you have a mortgage. you should own your own property"

Asian wives have a really high expectation. while she is loyal, doesn't drink and has a lot of good qualities, she has never once shown gratitude for what i do, never said well done and always acts like she's had to settle for a life of poverty because I'm not a multi millionaire and sadly my family are poor as church mice so its taken me till middle age to get anywhere. i didn't have a house deposit or money for a business, a lot of asian men seem to get given family money and im being compared to them.

you’re right. I’m actually top 1%We’ll, she did have a valid point for calling you out on a top 10%

Lol, seriously?you’re right. I’m actually top 1%

Infographic: How much pay makes you a top earner in the UK?

This infographic shows the average annual gross pay of UK employees in the top earning percentiles in 2019.www.statista.com

No, I hacked the national statistics website and faked that post to prove a point.Lol, seriously?

I’m not sure the point you’re making.Believe whatever you want to think is true

Why did you divide the $20m in half?If half of the $20m is generating that 4% you're referencing, that's $400k per year. Spending about $240k just to live a comfortable life with nothing too extravagant. upper middle class vacations, dining, and overall living while still putting aside some cash in the bank.

I'm sure you love your children but your wife is really disrespectful. Long term this can have a huge impact on your self worth. Hopefully these are isolated incidences, if you not might be a good idea looking at option.yep. And married.

Early on in my life, I determined that society is setup in a way where most people are doomed to be poor and stuck in the rat race. System is built off credit. In order to build credit, you need to take on debt. There's little guidance from society for most on how to properly build credit unless you self educate, but once you turn 18 years old your thrown into the trend of borrow for college, taking out credit cards, buying a car, etc. before you've even gotten your ears wet around financial education. 401k's, pensions, the 4% rule, etc. are designed in way to keep most people enslaved in debt for the majority. Those that believe in these things, more power to you but when the government's sole interest is to keep the rich, rich, and make them even richer while keeping the poor complacent and naive, I tend to not follow the herd.Why did you divide the $20m in half?

I've read about the 4% rule over and over online and in books. Your misunderstanding of it suggests you've never heard of it. What is your investment experience?

ian wives have a really high expectation. while she is loyal, doesn't drink and has a lot of good qualities, she has never once shown gratitude for what i do, never said well done and always acts like she's had to settle for a life of poverty because I'm not a multi millionaire and sadly my family are poor as church mice so its taken me till middle age to get anywhere. i didn't have a house deposit or money for a business, a lot of asian men seem to get given family money and im being compared to them.

Yeah but that’s not reality my friend. You are top 3%.Lol, seriously?

I make more than twice as much and I wouldn’t even consider myself in the top 25% percentile.

If my wife says that to me I will check that shvt real quick. She knows better, There are plenty of women that happy to take her place.I try to explain to my wife that I’m top 10% earners but she still says “you don’t earn that much and you’re not wealthy”.

She says she’ll only give up work to be a housewife if I can hand her $2,700 a month as an allowance.

There are lots of women I feel who would be very proud of a man making that money.

Women are born complainers.

Amen!I'd rather be single than be with someone that doesn't appreciate me. I've told my wife, she's here to make my life better and vice versa. If it's not the case, than what is the point of our relationship. It's supposed to be mutually beneficial. If she ever feels like she deserves someone better or wants something better, I've told her she's free to leave. Those are the conditions of our relationship and she agrees to them. I don't get much complaining.

Wife is also Asian.

Absolutely agree, the system is basically designed to keep people as debt slaves their entire lives. Simply having a middle class salary and saving 10% a year, not going to work out for most. When you are salaried and have a dependable income and incremental raises, most just eat those up in lifestyle inflation. You have to either have successful parents who teach you about asset ownership/business to look at money differently or self educate. You really have to take on the responsibility to understand what you are investing in and not just count on someone else to do it for you. One of the most important aspects engrained in you when you are a business owner compared to an employee is that your income can be extremely volatile year to year. You are also just one major lawsuit or event away from having to completely start over. Because of this always being a possibility, in the good times, you really build up that war chest and become more reluctant to take on luxury lifestyle liabilities until you can actually afford it. For myself, once I got all my debt paid off and my business to a high income, around year 5. The next 7yrs I saved/invested over 50% of my income. Ill add a few of my observations on what mattersEarly on in my life, I determined that society is setup in a way where most people are doomed to be poor and stuck in the rat race. System is built off credit. In order to build credit, you need to take on debt. There's little guidance from society for most on how to properly build credit unless you self educate, but once you turn 18 years old your thrown into the trend of borrow for college, taking out credit cards, buying a car, etc. before you've even gotten your ears wet around financial education. 401k's, pensions, the 4% rule, etc. are designed in way to keep most people enslaved in debt for the majority. Those that believe in these things, more power to you but when the government's sole interest is to keep the rich, rich, and make them even richer while keeping the poor complacent and naive, I tend to not follow the herd.

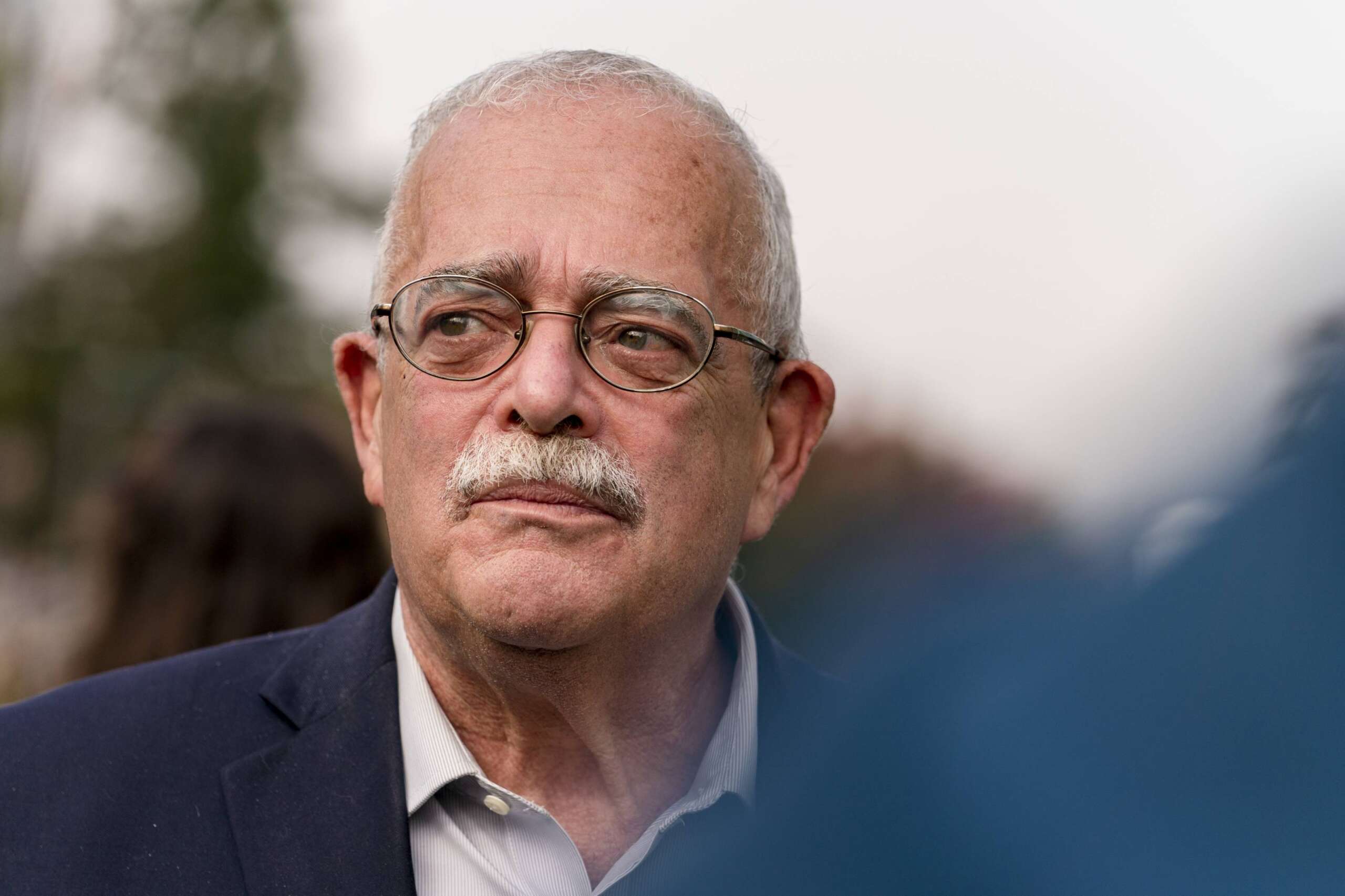

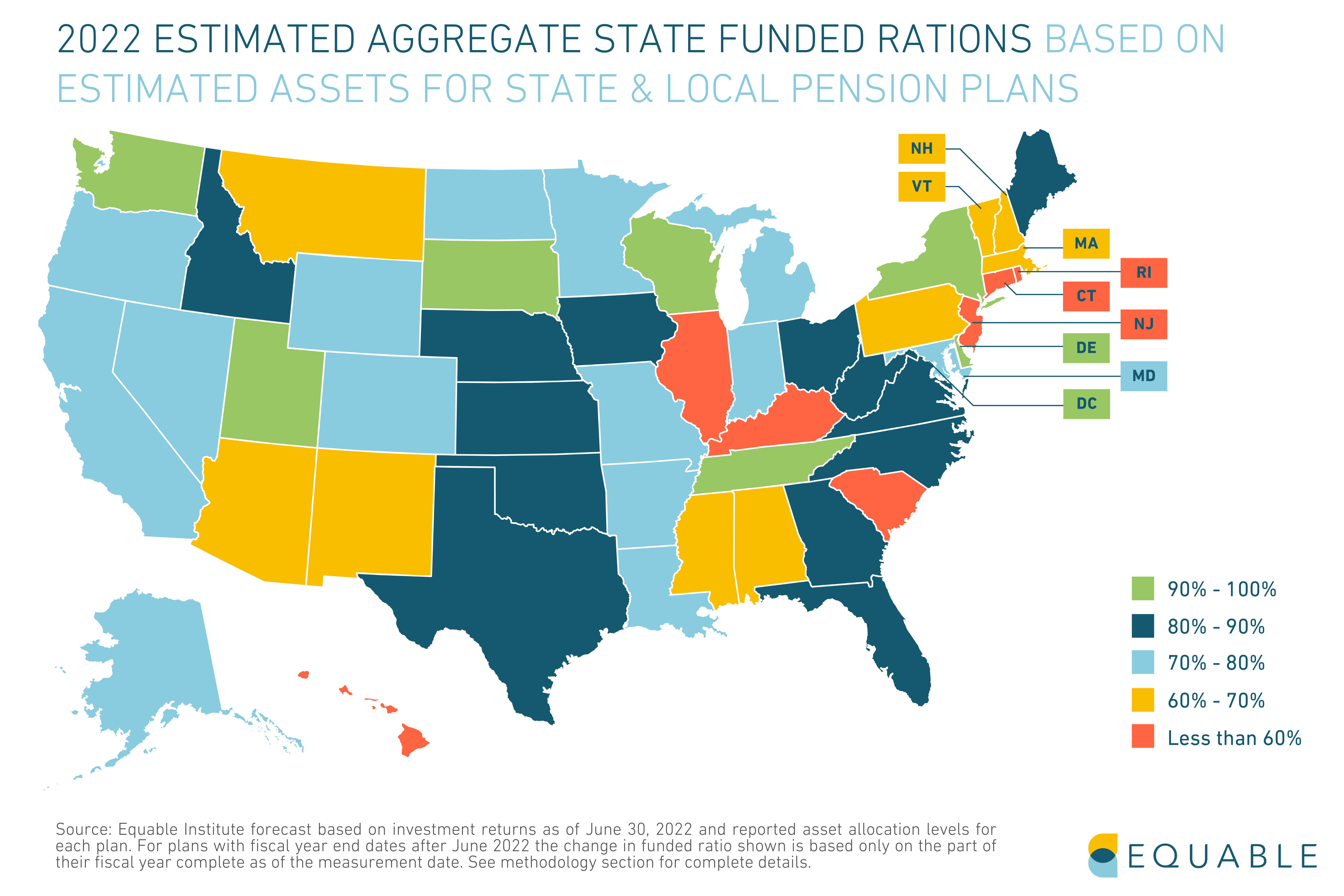

The Fed is hiking interest rates in a way which will decimiate 401k's, and on the off chance that it doesn't and we inflate our way to continuous new all time market highs, than great, you stocks will be maybe 50% or double what they're worth in dollars but overall losing considerable purchasing power. Those relying off pensions when the dollar is setting up for the largest dump in its history and the government deficity continues to increase with end of debt in sight, makes me feel sorry for those who invested their lives into these scam investments. I never expected the government or anyone other than myself to take care of me. So while most fell into this 50% to 100% increase, I was working towards 1,000% & 10,000% growth.

To follow traditional investment principles so I can finally free yourself from the debt based enslavement system when i'm in my 50's or 60's may be acceptable to most here, but to me is not acceptable. I refused to be a slave to the system and was willing to get rich or die trying. My goal was not to survive in the system, but thrive inside and outside of it. You never become successful or an outlier statistics by following the herd mentality/trend.

--

I'm 36 now and have made my fair share. Probably more than most on this forum. Started with nothing in my early twenties. Started studying markets and economics and very early on realized that they did not infact reflect the state of the economy. Much of it is based on geopolitics, global economics, insider information, and the information is extrapolated out to the point where its near impossible for anyone but those well connected, educated, to understand. Most people just close their eyes and buy stocks, throw into funds and retirement portfolio's because of this and "trust the process". Knowing that the process only allows you to reap the benefits when you're old, and that if you're lucky, I started to research into those that became extremely wealthy and any noticeable patterns.

The identifiable pattern from the really successful was not 4% rule or any of the other herd mentality investment strategies as stated above.

- go against the herd (if you don't want to be a sheep, don't act like one)

- foresight (ability to be forward looking and thinking to see things before they happen)

- identify counter trend opportunities and capitlize off them

- go big or go home and fail often

- one of the times, when you go big, you will strike gold. capitlize off this, and shift strategies to more safely preserve wealth.

--

Would love to hear your experience and if the 4% rule worked out for you?

Early on in my life, I determined that society is setup in a way where most people are doomed to be poor and stuck in the rat race. System is built off credit. In order to build credit, you need to take on debt. There's little guidance from society for most on how to properly build credit unless you self educate, but once you turn 18 years old your thrown into the trend of borrow for college, taking out credit cards, buying a car, etc. before you've even gotten your ears wet around financial education. 401k's, pensions, the 4% rule, etc. are designed in way to keep most people enslaved in debt for the majority. Those that believe in these things, more power to you but when the government's sole interest is to keep the rich, rich, and make them even richer while keeping the poor complacent and naive, I tend to not follow the herd.

The Fed is hiking interest rates in a way which will decimiate 401k's, and on the off chance that it doesn't and we inflate our way to continuous new all time market highs, than great, you stocks will be maybe 50% or double what they're worth in dollars but overall losing considerable purchasing power. Those relying off pensions when the dollar is setting up for the largest dump in its history and the government deficity continues to increase with end of debt in sight, makes me feel sorry for those who invested their lives into these scam investments. I never expected the government or anyone other than myself to take care of me. So while most fell into this 50% to 100% increase, I was working towards 1,000% & 10,000% growth.

To follow traditional investment principles so I can finally free yourself from the debt based enslavement system when i'm in my 50's or 60's may be acceptable to most here, but to me is not acceptable. I refused to be a slave to the system and was willing to get rich or die trying. My goal was not to survive in the system, but thrive inside and outside of it. You never become successful or an outlier statistics by following the herd mentality/trend.

--

I'm 36 now and have made my fair share. Probably more than most on this forum. Started with nothing in my early twenties. Started studying markets and economics and very early on realized that they did not infact reflect the state of the economy. Much of it is based on geopolitics, global economics, insider information, and the information is extrapolated out to the point where its near impossible for anyone but those well connected, educated, to understand. Most people just close their eyes and buy stocks, throw into funds and retirement portfolio's because of this and "trust the process". Knowing that the process only allows you to reap the benefits when you're old, and that if you're lucky, I started to research into those that became extremely wealthy and any noticeable patterns.

The identifiable pattern from the really successful was not 4% rule or any of the other herd mentality investment strategies as stated above.

- go against the herd (if you don't want to be a sheep, don't act like one)

- foresight (ability to be forward looking and thinking to see things before they happen)

- identify counter trend opportunities and capitlize off them

- go big or go home and fail often

- one of the times, when you go big, you will strike gold. capitlize off this, and shift strategies to more safely preserve wealth.

--

Would love to hear your experience and if the 4% rule worked out for you?

If you have no investment experience, people should not listen to your advice on retirement.Early on in my life, I determined that society is setup in a way where most people are doomed to be poor and stuck in the rat race. System is built off credit. In order to build credit, you need to take on debt. There's little guidance from society for most on how to properly build credit unless you self educate, but once you turn 18 years old your thrown into the trend of borrow for college, taking out credit cards, buying a car, etc. before you've even gotten your ears wet around financial education. 401k's, pensions, the 4% rule, etc. are designed in way to keep most people enslaved in debt for the majority. Those that believe in these things, more power to you but when the government's sole interest is to keep the rich, rich, and make them even richer while keeping the poor complacent and naive, I tend to not follow the herd.

The Fed is hiking interest rates in a way which will decimiate 401k's, and on the off chance that it doesn't and we inflate our way to continuous new all time market highs, than great, you stocks will be maybe 50% or double what they're worth in dollars but overall losing considerable purchasing power. Those relying off pensions when the dollar is setting up for the largest dump in its history and the government deficity continues to increase with end of debt in sight, makes me feel sorry for those who invested their lives into these scam investments. I never expected the government or anyone other than myself to take care of me. So while most fell into this 50% to 100% increase, I was working towards 1,000% & 10,000% growth.

To follow traditional investment principles so I can finally free yourself from the debt based enslavement system when i'm in my 50's or 60's may be acceptable to most here, but to me is not acceptable. I refused to be a slave to the system and was willing to get rich or die trying. My goal was not to survive in the system, but thrive inside and outside of it. You never become successful or an outlier statistics by following the herd mentality/trend.

--

I'm 36 now and have made my fair share. Probably more than most on this forum. Started with nothing in my early twenties. Started studying markets and economics and very early on realized that they did not infact reflect the state of the economy. Much of it is based on geopolitics, global economics, insider information, and the information is extrapolated out to the point where its near impossible for anyone but those well connected, educated, to understand. Most people just close their eyes and buy stocks, throw into funds and retirement portfolio's because of this and "trust the process". Knowing that the process only allows you to reap the benefits when you're old, and that if you're lucky, I started to research into those that became extremely wealthy and any noticeable patterns.

The identifiable pattern from the really successful was not 4% rule or any of the other herd mentality investment strategies as stated above.

- go against the herd (if you don't want to be a sheep, don't act like one)

- foresight (ability to be forward looking and thinking to see things before they happen)

- identify counter trend opportunities and capitlize off them

- go big or go home and fail often

- one of the times, when you go big, you will strike gold. capitlize off this, and shift strategies to more safely preserve wealth.

--

Would love to hear your experience and if the 4% rule worked out for you?

Why did you divide the $20m in half?

I've read about the 4% rule over and over online and in books. Your misunderstanding of it suggests you've never heard of it. What is your investment experience?

By "absolutely agree", I hope you exclude claims that pensions are "scam investments" and 401ks do not keep up with inflation.Absolutely agree, the system is basically designed to keep people as debt slaves their entire lives. Simply having a middle class salary and saving 10% a year, not going to work out for most.

If three or four people time the markets in a given year, one of them will beat the market by luck. If you call market timing "impossible", that lucky person could assume they can ignore your advice since the impossible happened. I would say market timing fails over years. It may work for a few years, but the odds fall every year.-Find a long term trend and be patient, sometimes years. Impossible to time markets in the short term. Don't take on too much leverage where you can not be patient

What makes any of your comments and claims here valid when you haven't shared anything?If you have no investment experience, people should not listen to your advice on retirement.

I asked for your investment experience, and you gave your life story. Although you did not directly answer my questions[1], your claim that 401k plans do not keep up with inflation is good enough: you do not understand investments. Historically, stocks outpace inflation. Look in pretty much any investment book to learn that. But you haven't read any investment books, have you?

You divided the $20m in half for no reason, which is why you didn't answer that question [1], either. If you can't explain why someone needs $20m vs $10m, maybe it's because you don't know.

I mentioned the 4% rule to test your knowledge, and you failed. You went from calling it my 4%, to calling it the 4% rule after I corrected you. The 4% rule is the most basic concept. Instead of learning that, you have learned to call pensions "scam investments" and claim 401k cannot keep up with inflation. So everyone with a pension or 401k is wrong, but you're right?

[1]

If you want to understand how the markets work, watch this insider scoop from O'keefe's Media Group who goes undercover to interview a blackrock employee that discusses how they manipulate markets with insider information, lie to the public about what investments and inversely trade against the public normies, as well as buy off both sides of politicians with all their gains to influence decision making. He also explains how most normal people are too stupid to understand any of this and how the world works. Sounds very much like @FlirtLife and other's that believe they're doing themselves service by following any of the investing principle's that have been mentioned here.Started with nothing in my early twenties. Started studying markets and economics and very early on realized that they did not infact reflect the state of the economy. Much of it is based on geopolitics, global economics, insider information, and the information is extrapolated out to the point where its near impossible for anyone but those well connected, educated, to understand. Most people just close their eyes and buy stocks, throw into funds and retirement portfolio's because of this and "trust the process".

Just keeping it brief. Of course not impossible and we all get lucky but unless you are one of the top investors it is a long term losing strategy. You do not want to build bad habits, eventually will pay the price. Agree the average investor will be served best to have a passive strategy. It takes many years of experience, aptitude, expensive lessons and being a student to have any sort of insight or edge. Any "hot" investment, usually by the time the general public participates the majority of the gains are gone and will most likely have a correction. I have made the most money on my investments when nobody paid attention and accurately predicted a future trend. You catch the entire move but need to be patient and properly assess the opportunity. If you do not want to be "average" that is how you can do it. Takes a lot of work and sacrifice thoughIf three or four people time the markets in a given year, one of them will beat the market by luck. If you call market timing "impossible", that lucky person could assume they can ignore your advice since the impossible happened. I would say market timing fails over years. It may work for a few years, but the odds fall every year.

There's a lot of research showing the average investor tries to chase the hot stocks or trends (like AI investing), and then winds up with performance below the market. From what I've seen, most investors do not learn or improve. For that majority (not all), switching to passive index funds / ETFs is an improvement.

Each pension is different but most of them are incredibly underfunded, most likely will not get many of the benefits promised. Everything is not necessarily a "scam" but it not how the majority of wealthy get there. If you want real financial independence early, going to be hard with just a 401k. It is better than nothing but is a slow long grind and many will not have enough to retire or keep up their living standards. The "scam" to me is the standard layout most make accumulating massive amounts of debt that you work your entire life to pay off. In my opinion, not the ideal way to do it. You have to have an above average commitment to get there.By "absolutely agree", I hope you exclude claims that pensions are "scam investments" and 401ks do not keep up with inflation.

I think you are missing the point. If you want to be above average you can't do what average people do. It isn't just making a few bets but a lifetime commitment to constantly learning, taking risks and properly allocating your money. The average person will not do this, above average people do do thisIf you have no investment experience, people should not listen to your advice on retirement.

I asked for your investment experience, and you gave your life story. Although you did not directly answer my questions[1], your claim that 401k plans do not keep up with inflation is good enough: you do not understand investments. Historically, stocks outpace inflation. Look in pretty much any investment book to learn that. But you haven't read any investment books, have you?

You divided the $20m in half for no reason, which is why you didn't answer that question [1], either. If you can't explain why someone needs $20m vs $10m, maybe it's because you don't know.

I mentioned the 4% rule to test your knowledge, and you failed. You went from calling it my 4%, to calling it the 4% rule after I corrected you. The 4% rule is the most basic concept. Instead of learning that, you have learned to call pensions "scam investments" and claim 401k cannot keep up with inflation. So everyone with a pension or 401k is wrong, but you're right?

[1]